- Alek's Real Estate Newsletter

- Posts

- February market update

February market update

What has the housing market done in 2025 so far, and where is it going from here? lets get in to the nooks and crannies of the situation here in the sunshine state!

Northeast Florida Real Estate Update – February 2025

Hello, Northeast Florida community!

As a seasoned real estate agent, I'm here to provide you with the latest insights into our local housing market. Let's dive into the current trends, interest rates, and inventory levels shaping our beautiful region.

Market Overview

January 2025 brought typical seasonal changes to the Northeast Florida housing market. Closed sales for single-family homes decreased by 39% from December, totaling 1,114 transactions. Pending sales also saw a decline of 14.9%, with 1,092 homes under contract. On a brighter note, new listings increased by 53.6% from December to January, bringing 3,340 homes to the market. This influx has nudged the Home Affordability Index up by 4.6%, reaching a score of 68.

What does The Home Affordability Index, mean? Don’t fear I got you! Simply put, Imagine you really want to buy a big, yummy candy bar. The Home Affordability Index is like a score that shows how easy it is to buy that candy bar with your allowance.

If the score is high, it means you have plenty of money, and you can buy the candy bar without any trouble. Maybe you’ll even have some money left for a toy!

But if the score is low, it means the candy bar is expensive compared to the money you have, and you might need to save up for a little longer. So, it’s like a game where a high score means, “Yay! I can buy it!” and a low score means, “Oh no, I need more money.”

Now, “everyone has a different score by that definition?”, was the first question I myself had. That is a great question too! It might seem that way, but the Home Affordability Index isn't actually different for each person. It's a number that shows how affordable homes are for an average family in a certain area.

It’s based on the average income of people living there and the average cost of homes. So, it’s like a general score for the whole neighborhood, not just one person.

But you’re right in thinking that people’s personal situations are different. Some people might find homes more affordable than others, depending on their income, savings, and expenses. The index just gives a general idea of how easy or hard it might be for most people in that area.

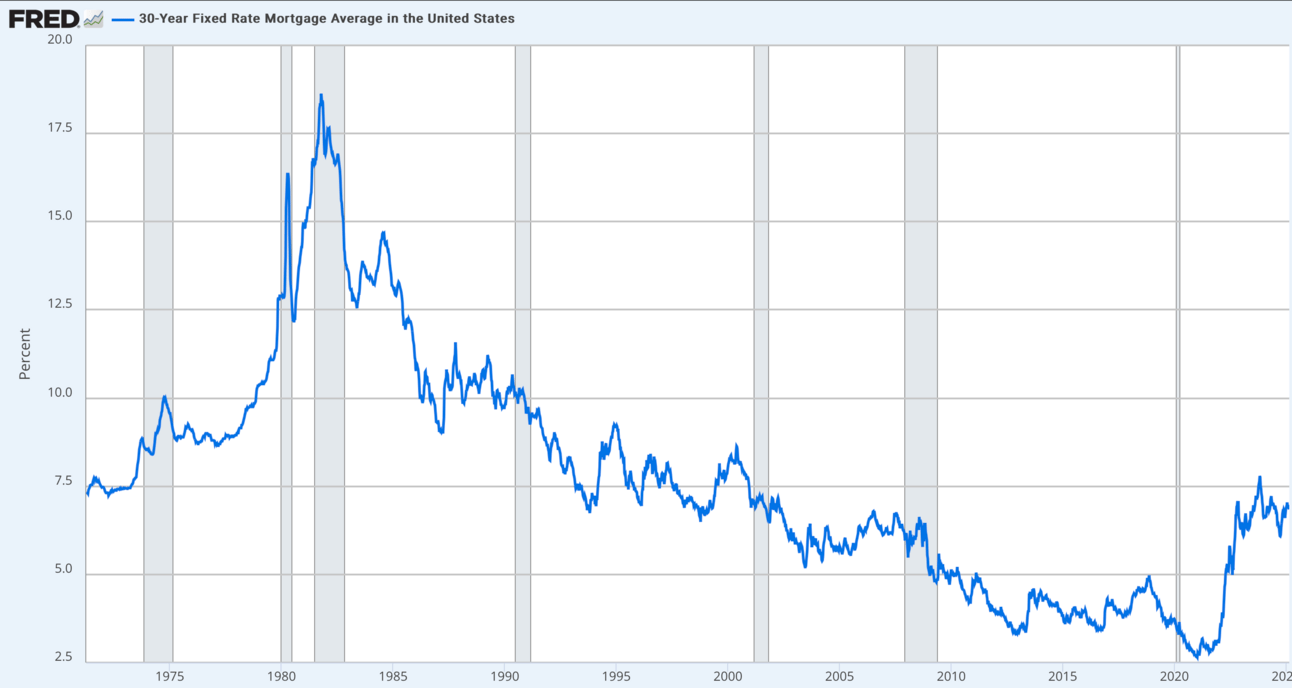

Interest Rates

Mortgage rates have been a hot topic lately. As of February 2025, the 30-year fixed mortgage rate hovers around 6.6%. Fannie Mae's Economic and Strategic Research Group anticipates these rates will remain steady, projecting an average of 6.6% for 2025 and a slight dip to 6.4% in 2026.

fanniemae.com there’s a link to read that article should you like to.

While these rates are higher than the historical lows we've enjoyed in the past, they reflect a stabilizing economy.

Inventory Levels

Good news for buyers: inventory is on the rise! January saw a 3.5% increase in available properties from the previous month and a notable 16.8% jump from last year. Despite this, the median home price climbed nearly 5% to $396,900. This combination of higher prices and increased inventory suggests a market that's balancing out, offering more options for buyers while maintaining value for sellers.

Looking Ahead

As we move further into 2025, the Northeast Florida housing market is expected to maintain its seasonal patterns. The recent uptick in new listings provides hope for buyers seeking more choices, while steady interest rates offer a degree of predictability for planning purposes. Whether you're looking to buy, sell, or simply stay informed, keeping an eye on these trends will help you navigate our dynamic market.

Remember, in real estate, the early bird catches the worm—but with the right strategy, even the night owl can find a cozy nest. If you have any questions or need personalized advice, don't hesitate to reach out. Here's to finding your perfect place in our vibrant community!

Warm regards,

Alek Meston

904 769 6643

Note: All data and projections are based on reports and forecasts available as of February 2025. Market conditions are subject to change.